DATAGIS Taking advantage of GIS to achieve increased quickness and precision for a new generation of the mortgage sector

The valuation process of a real property is paramount, as it helps financial institutions and their clients understand the value of any given property. Over the years, and as the real estate market continued to rise, valuators across the globe resorted to technological solutions to improve the efficiency and quickness of their assessments. However, due to a significant gap between valuators and the number of real estate assets requiring valuation -even the most sophisticated one – valuators began to experience increasing delays in their operations. Such gap is particularly strong in Latin America (LATAM), a market where 12,000 company valuators handle about 1.5 million properties, execution costs and delays in ultimately procuring the loan.

In parallel, the lack of standardized processes in LATAM’s real estate market also increases risks for Banks and other financial institutions in connection with the determination of the actual value of a property and the creation of an accurate mortgage. DATAGIS is a Costa Rica-based company with over six decades of valuation experience in LATAM, providing its state-of-the-art, GIS-driven ERP solution to connect valuators, institutions, and end clients.

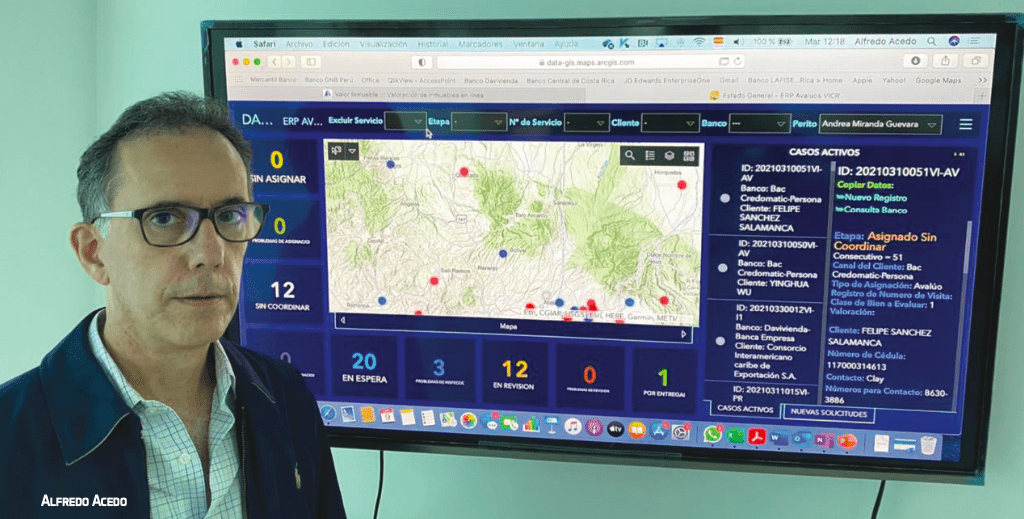

Following is a conversation that CIO Applications had with the CEO of DATAGIS Alfredo Acedo, about how his company, as a reliable partner of ESRI, provides tools and services to help clients perform their valuations, issue reports and create mortgage loans in a fast, efficient and affordable manner.

Can you give us a general overview on DATAGIS

As an organization, DATAGIS was founded when our group of interdisciplinary professionals identified the value in offering a unified ERP solution to create a shared ecosystem for financial institutions and valuation companies that may cooperate and communicate with each other. A big part of our success is based on the association with massive GIS mapping: ESRI, which allows us to create geographic references for each property and integrate information across all interest groups to speed up the mortgage creation process.

Through the ESRI ecosystem we allow valuators to perform a transparent GIS mapping, spatial analysis and share information directly collected by the bank.

Alternatively, our DATAGIS ERP help financial institutions to cleanse their mortgage creation processes, providing workflows designed to streamline the processable extraction procedure, knowledge about large datasets received from valuators, contractors and other related stakeholders. As part of our solution, we also provide business intelligence (BI) based on the current reality of the real estate and valuation areas, for purposes of helping eliminate risk in terms of pricing, credit applications, reports, and more.

Could you explain how does the ESRI of DATAGIS work?

The ERP solution and the benefits offered by it. Our DATAGIS ERP connects banks, borrowers, valuators, and developers simultaneously and within the same workflow, using the precision of GIS technology and big data-driven business intelligence. As for valuators, this solution simplifies the management of burdensome processes, gets rid of repetitive tasks and creates a database for future reference.

On the other hand, DATAGIS eliminates risks by transforming the assessment into a reliable and transparent process based on a real-time update of geospatial and market data. We provide a comprehensive virtual experience for banks, reducing their operation costs with respect to internal valuators or quality assurance, and improving value accuracy. We ultimately control any mortgage-related risks.

Lastly, from the developer’s point of view, this solution takes care of the workflow and any inefficiencies to foster a smooth and timely financing of your

real estate projects.

What is the commercialization strategy adopted by DATAGIS?

We adopted two market launch approaches, one targeting

financial institutions and another one oriented to valuators. Given the SaaS nature of our proposal, we can provide a set of tools for valuators along with special services such as the connection with developers and pricing plans. Alternatively, we provide financial institutions with different services such as risk and value-mapping, BI trend visualization and other services that add value to their general processes engaged in the creation of mortgage loans.

The use of said skills has helped DATAGIS achieve several success cases with clients that have seen their valuations reduced to half, which makes us competitive in terms of costs and gives the possibility to provide banks with information in a quick manner, minimize additional costs and eliminate delays. For example, Valorinmueble is one of these successful clients with over 50,000 transactions processed through DATA ERP GIS.

Can you describe how DATAGIS adapted to the impact of Covid-19?

Before the pandemic, valuators had to visit the properties, make

inspections, take notes and perform in-field work reporting any details to the relevant financial institution. Using our design tool, valuators acquired the capacity to perform inspections and communicate with owners to collect information on the property, which results in a safest, fastest and more precise valuation for the creation of the final mortgage.

Before the pandemic, valuators had to visit the properties, make

inspections, take notes and perform in-field work reporting any details to the relevant financial institution. Using our design tool, valuators acquired the capacity to perform inspections and communicate with owners to collect information on the property, which results in a safest, fastest and more precise valuation for the creation of the final mortgage.

The pandemic gave us the opportunity to reflect on our existence and future operations as a company. In fact, as soon as we anticipated the imminent restriction on human contact, we defined a virtual process to allow our clients: Banks, valuators, and appraisers to resume their operations in a safe manner. Moreover, our SaaS-based DATAGIS platform empowered clients by helping them conduct a critical optimization of their workflow, tasks and to communicate with other stakeholders from the comfort of their homes. Especially, the Covid-19 pandemic gave us the opportunity to reinvent our processes and provide better solutions.

What would the future hold for DATAGIS?

As a result of the pandemic, assessing our future is challenging, but through the basic skills of our ERP solution and our partnership with ESRI, our goal is to take our business to other Latin American countries, starting with Colombia, Panama and Ecuador, aside from Costa Rica and Peru where we already operate.

For this, we are looking for distribution allies and making strategic partnerships with emerging tech companies in the LATAM real estate market, which would allow us to start our second venture capital fundraising round. As CEO of DATAGIS, I feel very confident that the future of the company is ready to capitalize on the increased market opportunities we are seeing in the real estate, mortgage and industry valuation sectors.